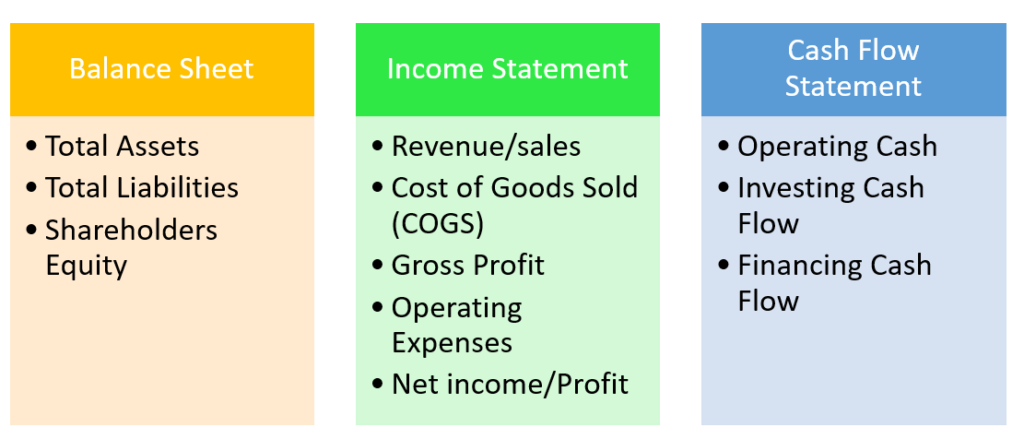

In my earlier blog post, “The Power of Financial Analysis in Evaluating Organizational Health,” we delved into the significance of utilizing financial analysis as a crucial tool for assessing the overall well-being of an organization. Today, we continue our exploration by focusing on three fundamental financial statements: the Balance Sheet, Income Statement, and Cash Flow Statement. These statements hold the key to unlocking a deeper understanding of a company’s financial standing and play a pivotal role in guiding end users toward informed decision-making. By combining insights from these statements, we can gain a comprehensive view of an organization’s financial health, enabling us to identify strengths, weaknesses, and potential growth opportunities. Join us as we shed light on the importance of each statement and learn how to interpret the right data to drive informed strategies in various scenarios.

1. The Balance Sheet:

The Balance Sheet, also known as the Statement of Financial Position, is a snapshot of a company’s financial position at a specific point in time. It presents a clear picture of the company’s assets, liabilities, and shareholders’ equity. For end users, key data to look for in the Balance Sheet include:

a) Total Assets: This represents the total value of everything owned by the company, including cash, investments, property, and equipment.

b) Total Liabilities: It shows the company’s debts and obligations to external parties.

c) Shareholders’ Equity: Calculated by deducting total liabilities from total assets, this figure represents the value left for shareholders after paying off all debts.

The Balance Sheet’s importance lies in assessing a company’s solvency, liquidity, and overall financial stability.

2. The Income Statement:

The Income Statement, also known as the Profit and Loss (P&L) Statement, provides a summary of a company’s revenues, expenses, and profits over a specific period. For end users, key data to focus on in the Income Statement are:

a) Revenue/Sales: This represents the total income generated from the company’s primary operations.

b) Cost of Goods Sold (COGS): The direct costs associated with producing goods or services.

c) Gross Profit: Calculated by subtracting COGS from Revenue, this figure shows the company’s profitability at the basic operational level.

d) Operating Expenses: These include all costs incurred to run the business, such as salaries, marketing, and administrative expenses.

e) Net Income/Profit: The final result after deducting all expenses from revenue, indicating the company’s overall profitability.

The Income Statement is crucial for evaluating a company’s revenue-generating abilities, cost management, and net profitability.

3. The Cash Flow Statement:

The Cash Flow Statement provides a detailed record of a company’s cash inflows and outflows during a specific period. It is categorized into three sections: operating activities, investing activities, and financing activities. End users should look for the following data:

a) Operating Cash Flow: This represents the cash generated or used in the company’s core operations.

b) Investing Cash Flow: Reflects cash flows from buying or selling assets, investments, or other long-term ventures.

c) Financing Cash Flow: Shows cash flows related to debt, equity, and dividend payments.

The Cash Flow Statement is essential for assessing a company’s ability to manage its cash position, identify cash sources, and evaluate its cash flow stability.

Combining the Three Statements:

To gain a comprehensive view of an organization’s financial health, it is crucial to analyze all three financial statements together. Here are some scenarios where analyzing the combination of these statements is necessary:

1. Assessing Liquidity and Financial Stability: By comparing the liquidity ratios derived from the Balance Sheet with the cash flow from the Cash Flow Statement, end users can understand if the company has sufficient cash to meet its short-term obligations.

2. Evaluating Profitability and Cash Flow Performance: Comparing the net income from the Income Statement with the operating cash flow from the Cash Flow Statement helps determine if the company’s profits are translating into positive cash flow.

3. Detecting Financial Red Flags: Analyzing the trend of various financial metrics across the three statements can reveal potential financial issues or areas of concern that need attention, such as increasing debt levels, declining cash flow, or decreasing profitability.

Conclusion:

Financial analysis is a powerful tool that enables end users to evaluate an organization’s health, make informed decisions, and plan for the future. Understanding the Balance Sheet, Income Statement, and Cash Flow Statement allows investors, stakeholders, and management to gain valuable insights into a company’s financial performance, profitability, liquidity, and long-term sustainability. By combining these three statements, businesses can develop a holistic view of their financial standing, ultimately leading to more strategic and well-informed decision-making processes.